![]()

![]()

Nayarit Gold Inc.

COMPANY DATA | INTRODUCTION

| PROJECT IN HAND | MANAGEMENT

NEWS UPDATE | CHINESE

| Address: | 20 Victoria Street, Suite 800 Toronto, Ontario Canada M5C 2N8 |

| Tel No.: | (647) 477-6264 |

| Fax No.: | (647) 477-6265 |

| Web Site: | www.nayaritgold.com |

| Corporate Email: | info@nayaritgold.com |

| Contact Person: | Michael Dehn |

| Position: | President, CEO & Director |

| Traded Market: | TSX-V |

| Traded Symbol: | NYG |

| Outstanding Shares: | 35,032,547 |

| Public Float: | 3,354,1000 |

| 52 Week High: | $ 1.92 |

| 52 Week Low: | $ 0.30 |

| Present Price: | Click Here |

INTRODUCTION

Nayarit Gold Inc. is a newly formed junior mineral exploration company. Management's strategy is to build Nayarit Gold into a profitable resource company and maximize shareholder value through successful exploration by means of cost-effective examination and early drill testing of high quality precious metal properties in prolific mining district in Mexico.

Nayarit Gold's management team consists of highly experienced mining and financial professionals. The Company utilizes cost-effective exploration by acquiring quality, drill-ready properties in prolific mining district and applying the best available exploration technologies to prioritise targets. The highest priority targets are tested early by drilling with only the best being advanced.

Nayarit Gold is exploring for gold and silver within the proven precious metal producing districts of Mexico. As new opportunities arise, wherever they may be, Nayarit Gold is well positioned to act on them.

PROJECT IN HAND

Orion Gold Project, Mexico

The Orion Gold Project is located 109 km NNW of the city of Tepic, the capital of the state of Nayarit, and 8 km SSE of the town of Acaponeta. Project co-ordinates are 105°16'W and 22°26'N.

Three contiguous mineral exploration concessions totalling 8,324.3 ha are held by Nayarit Gold Inc.'s Mexican subsidiary, Nayarit Gold de Mexico S.A. de C.V. and include the following:

|

Concession |

Area |

Nayarit

Gold Ownership |

|

|

|

|

|

Orion |

527.5021

ha |

100%

(3.5% NSR) |

|

|

|

|

|

El

Magnifico |

7,650.4432

ha |

100% |

|

|

|

|

|

La

Estrella |

146.3529

ha |

Under

option to purchase 100% |

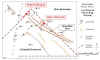

The Orion Gold Project is situated in the western edge of the Sierra Madre Occidental (SMO) metallogenic province, a large Mid-Tertiary volcanic terrane, which is one of the world's largest epithermal precious metal terranes and hosts a majority of Mexico's gold and silver deposits.

large Mid-Tertiary volcanic terrane, which is one of the world's largest epithermal precious metal terranes and hosts a majority of Mexico's gold and silver deposits.

Geologically, the SMO is divided into two main volcanic units referred to as the Upper Volcanic Group and Lower Volcanic Group:

The Lower Volcanic Group (LVG) consists mainly of 45 Ma andesitic tuffs, flows and breccias. The LVG host approximately 95% of the important precious metal deposits and is considered to be one of the most mineralized lithologic units in Mexico. Various felsic intrusive suites intruded the LVG.

The Upper Volcanic Group (UVG), 32 to 23 Ma, rests unconformity upon the LVG and consists of intermediate ash-flows tuffs, ignimbrites and air-fall tuffs capped by rthyolitic ash flow tuffs.

ash-flows tuffs, ignimbrites and air-fall tuffs capped by rthyolitic ash flow tuffs.

Gold mineralization on the Orion Gold Project is of the low sulphidation epithermal type. Several north east trending pyritized and silicified breccia zones and mineralized quartz veins occur on the project. Gold mineralization occurs as native gold associated with remnant pyrite in the oxidized zone (10-30 metres thick) and as native gold and gold-bearing telluride in the sulphide zone. The mineralization is anomalously high in gold compared to silver relative to the region with an Ag/Au ratio of 0.5 compared to the typical 30 to 50.

Between 1993 and 1994, Lac Minerals USA Inc. carried out an extensive exploration program on the La Estrella and Orion concessions. This work included reconnaissance and detailed geological mapping, stream sediment sampling, 1,150 soil samples, 1,300 grab rock samples, 15 line km of IP/Resistivity, 50 line km of magnetic surveys and 2,461 metres of reverse circulation drilling in 21 holes. Six holes reported intersections above 1.0 g/t Au over considerable widths. The best intersection was 28.2 g/t Au and 3.5 g/t Ag over 1.53 m from hole E94-1.

reverse circulation drilling in 21 holes. Six holes reported intersections above 1.0 g/t Au over considerable widths. The best intersection was 28.2 g/t Au and 3.5 g/t Ag over 1.53 m from hole E94-1.

Based on the work to date the Orion Gold Project has the potential to develop into a profitable underground gold mine. Oxidized heap-leachable material is limited to the upper 10-30 metres. The main target is the thick panel of high-grade sulphide ore.

Proposed Phase One Work Program

The objective of the Phase One exploration program is two-fold:

1. drill test the Orion Main Zone structure with ten to twelve (10-12) core diamond drill holes to follow-up on the success of the previous reverse circulation drilling;

2. conduct regional exploration by prospecting, mapping and sampling areas with geophysical, rock and stream sediment anomalies.

Proposed Phase Two Work Program

Contingent upon positive results, an aggressive Phase Two diamond drilling program will be implemented to follow-up and delineate targets identified in Phase One. Phase two will consist of infill diamond drilling on the Orion Main Zone structure and reverse circulation drilling of significantly anomalous targets identified during the regional program.

Why Explore in Mexico?

· Over 63 million ounces of gold and 10 billion ounces of silver has been produced;

· An additional 23 million ounces of gold have been discovered since 1992;

· Much of the gold is high grade Bonanza style;

· Sierra Madre Occidental is the largest epithermal precious metal province in the world and hosts a majority of Mexico's gold and silver deposits;

· Modern exploration in Mexico did not start until 1992;

· Modernized mining regulations allow 100% foreign ownership and repatriation of profits;

· One of the top 10 countries in the world to develop a mine (Fraser Institute).

MANAGEMENT

Nayarit Gold Inc. has a well management team with experience in different areas.

Michael A. Dehn, Oakville, ON, President, CEO and Director

Mr. Dehn, a former senior geologist for Goldcorp Inc., has been active in the mining industry involved in exploring for precious metals, base metals, diamonds and industrial minerals, as well as financing, marketing and project management, since 1994. He graduated from the University of Waterloo with a B.Sc. in Earth Science in 1993, and has worked extensively with new regional exploration technologies including remote sensing, computer modelling, geophysics and geochemistry. Currently he is an officer and/or director of other publicly listed companies, and occasionally consults on projects within the Red Lake Gold Camp.

Dennis H. Waddington, Toronto, ON, Chief Financial Officer

Mr. Waddington is a consultant with over thirty years of business and professional experience in mineral exploration and related fields. Prior to commencing his consulting practice, he was in management and field operations with public and private companies active in the minerals industry in Canada and overseas. He is a professional geoscientist (P.Geo.) who holds B.Sc. and M.Sc. degrees in Geology from the University of Toronto as well as an MBA degree from the Schulich School of Business at York University.

Dale M. Hendrick, P.Eng., Toronto, ON, Director

Mr. Hendrick is a senior geological consultant with extensive experience in precious metals, base metals, uranium, coal and natural gas exploration, development, production and financing. Following a 28-year career with Kerr Addison Mines and the Noranda Group where he attained senior executive positions, he formed Dale M. Hendrick & Associates, through which he has provided consulting services to mining companies around the world, including Mexico. He also serves on the board of a number of publicly listed mining companies which presently include Cline Mining Corporation, Gammon Lake Resources Inc., Mexgold Resources Inc. and Radisson Mining Resources Inc.

The Honourable J. Trevor Eyton, O.C., Toronto, ON, Director

Senator Eyton is a Member of the Senate of Canada and a director of Brookfield Asset Management Inc. and Coca-Cola Enterprises Inc. He is also Chairman of Canada's Sports Hall of Fame and a Governor of the Canadian Olympic Foundation and Junior Achievement of Canada. In 2002 he was awarded Mexico's Aguila Azteca - the highest award given to foreigners by the government of Mexico. Senator Eyton is also the co-founder and co-chairman of the Canada/Mexico Retreat, a volunteer organization formed in 1990 involving most senior business and government people for the purpose of promoting two-way trade and investment.

John A. Ryan, Simcoe, ON, Director

Mr. Ryan is President, Chief Executive Officer and a director of Spruce Ridge Resources Ltd., a gold and lead exploration company with properties in Ontario and Newfoundland. He is a professional accountant, holding a CGA designation, with over 20 years of management experience in various industries and as President of Nichange Enterprises Ltd., provides financial consulting services to corporate and individual clients.

Gerald Shefsky, Toronto, ON, Director

Mr. Shefsky is a senior businessman with extensive experience in entrepreneurial ventures. Since 1982, Mr. Shefsky has been involved in the venture capital market and has extensive experience in real estate development in North America and Europe. Mr. Shefsky is currently a director and Chairman of Aquarium Development Corporation, a private entertainment company.

NEWS UPDATE

On March 02, 2007 TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced on January 12, 2007. Number of shares: 2,811,500 Purchase price: 70 cents per share.

On February 22, 2007 Nayarit Gold Inc. has closed a non-brokered private placement financing of $1,968,050, comprising the sale of 2,811,500 units sold at 70 cents per unit. This financing represents the results of the financing of up to $2.1 million first announced on January 12, 2007.

On February 01, 2007 Nayarit Gold Inc. has released follow-up exploration results from the 200 hectare Bonanza 1 concession. A well mineralized silver-gold vein breccia system, referred to as El Carmen, is 400 metres north of the previously announced La Escondida, La Cumbre and La Morena underground workings, and the Bonanza 1 structure. This mineralized vein breccia system, Carmen Norte, runs parallel to the Bonanza 1 structure, roughly trenching east-west.

On January 17, 2007, Nayarit Gold Inc. announced that its previously announced non-brokered private placement is now fully subscribed and all 3 million units have been placed. The subscribers are almost equally split between institutional and retail investors.

On January 12, 2007, Nayarit Gold Inc. announced that it is proposing a non-broker private placement financing of a minimum of $750,000 and up to a maximum $2.1-million comprising the sales of up to 3 million units, to be sold at 70 cents per unit, subject to regulatory approval and closing. Each unit consists of one common share and one-half of one common share purchase warrant.

On December 29, 2006, Nayarit Gold Inc. announced that warrantholders have exercised all 25-cent warrants outstanding for proceeds of $375,000. Proceeds received from these warrants will be used for exploration activities on the Company's mineral properties in Mexico, and for general working capital including complementary acquisitions.

On December 05, 2006 Nayarit Gold Inc. has provided exciting exploration results from its Dorosa property. Results from the Dorosa are exceeding management's expectations which include:

- San Valentin vein assay grab sample up to 1,750 grams per tonne silver and 1.36% lead;

- San Valentin vein assays 1.150 grams per tonne silver over a 0.5-metre width at in-chip channel samples;

- El Naranjo West vein assays 646 grams per tonne silver over a 0.53m width;

- La Poza West vein assays 964 grams per tonne silver and 2.01% zinc over a 0.6m width;

- Additional high-grade samples from La Poza and El Rosario;

- Samples at lab from first hole at Real de Belem for analysis; and

- Dorosa is procedding according to schedule and results to date are exceeding management's already high expectations.

On November 30, 2006 Nayarit Gold inc. has provided the follow up exploration results from the 207.5 hectare Bonanza 1 concession. A total of 46 chip-channel samples were collected from surface and underground along approximately 400 metres of strike length of the El Carmen vein system. Additional samples from further work, still continuing, along the El Carmen vein system have been sent to ALS Chemex for analysis.

On November 29, 2006 Nayarit Gold Inc. has arranged a proposed non-brokered private placement financing of a minimium of $2.5 million and up to a maximum of $3.6 million comprising the sale of up to four million units, to be sold at 90 cents per unit, subject to regulatory approval and closing. Proceeds of the financing will be used for exploration activities on the company's mineral properties in Mexico, and for general working capital including acquisitions that complement the company's existing exploration strategy.

On November 16, 2006 Nayarit Gold Inc. has released the first pass exploration results from the additional 17,436 hectares of high-mineral-potential ground recently staked at Dorosa in Mexico state, Mexico.

Highlights:

- grab samples from new claims return up to 220 grams per tonne silver;

- La Poza vein traced for more than 1,000 meters on surface;

- El Rosario vein traced for more than 2,000 meters on surface;

- La Esperanza grab sample return 200 grams per tonne silver; and

- lead values up to 4.28 per cent, zinc up to 2.16 per cent from the El Rosario vein

On November 03, 2006 Nayarit Gold Inc. has acquired, by staking, an additional 17,436 hectares of high minerals potential land surrounding the existing 1,989 hectares it already controls at Dorosa in Mexico state, Mexico, bringing the total of the Dorosa land area of the Dorosa project lands package to 19,425 hectares. This additional land was staked at minimal cost, and all concessions that together form the Dorosa project lands have no royalties. The application to obtain the new mining concession has been accepted with expedient status and is under the normal process of review in compliance with Mexican mining law and its regulations.

On October 4, 2006, Nayarit Gold Inc. announced that it has received results from the first six drill holes completed in this year's drillingon the Orion-Estrella project located in Mexico. Sampling of diamond drill hole OR06-21 returned 6.9 g/t Au over 6 metres including 17.23 g/t Au over 2 metres.

On September 20, 2006, Nayarit Gold Inc. announced that it has signed an agreement under which it has the right to acquire the Dorosa property located in the historic Sultepec silver-gold mining district in Mexico state, Mexico. The property contains known mineralization with high concentrations of silver, confirmed from prior small-scale production, more recent diamond drilling and Nayarit's own sampling. This agreement will give Nayarit Gold an opportunity to get a fast and cost-effective start exploring an exciting new target in addition to its existing properties in Nayarit state.

The property contains two sets of underground workings from earlier times, in four contiguous mining concessions totalling 1,989 hectares. These underground workings are known as the Real de Belem mine and the historic San Antonio mine.

On August 22, 2006, Nayarit Gold Inc. announced that it has completed a first phase of a mobile metal ion (MMI) soil geochemical survey at Lazaro Cardenas. Lazaro Cardenas silver zone confirmed by MMI soil survey.

On August 10, 2006, Nayarit Gold Inc. announced that it has completed a first program of underground sampling and mapping at EL Frontal which returns significant Au-Ag-Pb-Zn from underground.

Highlights:

· Approximately 400 metres of underground workings mapped and sampled;

· Gold in chip-channel samples as high as 6.18 g/t over 1.90 m (0.18 oz/t over 6.23 feet);

· Silver in chip-channel samples as high as 179 g/t over 0.94 m (5.22 oz/t over 3.15 feet);

· Lead in chip-channel samples as high as 3.44% over 1.20 m (3.94 feet); and

· Zinc in chip-channel samples as high as 1.70% over 1.20 m (3.94 feet).

On August 3, 2006, Nayarit Gold Inc. announced that it has completed a first program of underground sampling and mapping at EL Frontal, and is awaiting assays results. El Frontal is a zone of gold and silver mineralization on the Gross concession with previous underground workings providing access to the mineralized system in three dimensions.

On July 24, 2006, Nayarit Gold Inc. announced that it has appointed P. Marius Mare, MSc, P.Geo., as vice-president of exploration. Mr. Mare formerly a senior geologist for Placer Dome, Tanzania, will assume his duties immediately with responsibility for the exploration and development of the Orion gold project in Mexico, as well as new project development.

On July 17, 2006, Nayarit Gold Inc. ( the optionor ) has entered into a letter of intent agreement with Haweye Gold &

Diamond Inc. to earn up to a 60% interest in the El Frontal property which totals approximately 2,900 acres and is located

near Acaponeta in the state of Nayarit, Mexico. The El Frontal has drill-ready targets identified through prior work and

likely other targets as well.

On July 12, 2006, Nayarit Gold Inc. announced that it has explored the underground workings, El Frontal, on recently

staked concessions near Acaponeta, Nayarit, Mexico. The El Frontal mine was opened from the late 1880s until 1936 when

activities ended, and only limited work occurred after the Mexican Revolution. In 1983, the Consejo de Recursos Minerals

completed a mapping and sampling program of the underground workings of the El Frontal Mine. The Consejo reports that a

minimum of 1,555 metres of underground development exists as part of the El Frontal mine.

On July 12, 2006, Nayarit Gold Inc. announced that it has explored the large underground workings, El Frontal, on recently staked concessions near Acaponeta, Nayarit, Mexico. In the past report ( prepared by Consejo de Recursos Minerales ), it indicated that a minimum of 1,555 metres of underground development exists as part of the El Frontal mine. It also reported that a non-43-101 compliant resource of 22,132 tonnes in two blocks.

On June 06, 2006, Nayarit Gold Inc. has completed its first hole in a planned 26-hole diamond core drilling program. The shortest holes are planned to be 200 metres, with the longest to be 600 metres. Coring productivity has been slow, but steady, due to blocky ground conditions, and often intense clay alteration of andestic rocks. The first hole was designed to test the down dip extension of the Orion mineralized zone (OMZ) 200 metres below surface and the Orion FW zone, as well as potential hangingwall strctres. The second hole is designed to test the down dip extension of the OMZ 400 metres below surface.

On June 05, 2006, Nayarit Gold Inc. provided prospecting results from surface sampling of several new mineralized systems on its claims near Acaponeta, Nayarit, Mexico. Sampling was completed by ASK Prospecting and Guiding of Gambo South, Newfoundland. Several new mineralized systems have been identified and initial sampling of structures at surface has returned significant results.

A total of 29 grab samples were collected by ASK Prospecting and Guiding in May, 2006, covering four areas. Encouraging silver values were reported from all samples and from this first-pass prospecting, three distinct, mineralized occurrences were discovered. The Navro occurrence is a copper- and lead-rich system with minor gold, silver and zinc values. Values from Navro return up to 2.16 grams per tonne gold, 43.30 grams per tonne silver, 3.95% copper, 7.37% lead and 0.25 gram per tonne zinc.

On May 26, 2006, Nayarit Gold Inc. has acquired an additional concession and results of surface sampling of a new mineralized zone identified by prospecting on this new concession near Acaponeta, Nayarit, Mexico. A semi-massive to massive silphide system has been identified from the initial prospecting on the "El Dorado" concession with values of up to 2.78% copper.

Based on continued compilation and targeting, Nayarit Gold acquired an additional 13,740 hectares, the El Dorado concession, approximately 30 kilometres southeast of Nayarit Gold's original concessions in the area, the Estrella and Orion concessions. This brings the total area of Nayarit Gold's contiguous concessions in Mexico to more than 107,000 hectares ( more than 1,070 square kilometers ).

On March 30, 2006, Nayarit Gold Inc. released assay results from underground sampling of the Minas de Animas mineralized zone on its claims near Acaponeta, Nayarit, Mexico. Highlights of the current results include:

· Significant silver results from three of four underground workings;

· Minas de Animas and San Francisco contain development of 360 metres along main structure;

· Composite intervals of up to 24.2 grams per tonne gold and 3,315.7 grams per tonne silver over 3.8 metres; and

· Footwall zone returns results of up to 1,345 grams per tonne silver over 1.8 metres.

On March 27, 2006, Nayarit Gold Inc. released results of surface sampling for a new mineralized zone on its claims near Acaponeta, Nayarit, Mexico. A new mineralized system containing gold and silver-rich vein and silicified breccia material in a large structure zone has been identified, and initial mapping and sampling of structures at surface have returned significant results including:

· 1.04 g/t Au and 135 g/t Ag over one metre (0.03 oz/t Au and 3.94 oz/t Ag over 3.28 feet);

· 2.23 g/t Au and 217 g/t Ag over one metre (0.07 oz/t Au and 6.33 oz/t Ag over 3.28 feet);

· 0.69 g/t Au and 909 g/t Ag over one metre (0.02 oz/t Au and 26.51 oz/t Ag over 3.28 feet); and

· 7.16 g/t Au and 101 g/t Ag over one metre (0.21 oz/t Au and 2.95 oz/t Ag over 3.28 feet).