![]()

![]()

Consolidated Spire Ventures Ltd.

COMPANY DATA | INTRODUCTION

| PROJECTS IN HAND | MANAGEMENT

NEWS UPDATE | CHINESE

| Address: | 615 - 700 West Pender Street Vancouver, BC Canada V6C 1G8 |

|

| Tel No.: | (604) 662-7455 | |

| Fax No.: | (604) 683-1055 | |

| Web Site: | www.spireventures.com | |

| Corporate Email: | info@spireventures.com | |

| Contact Person: | Brian Buchanan | Dee Sauve |

| Position: | President | Corp. Admin. |

| Traded Market: | TSX-V |

| Traded Symbol: | CZS |

| Outstanding Shares: | 38,784,256 |

| 52 Week High: | $ 0.85 |

| 52 Week Low: | $ 0.125 |

| Present Price: | Click Here |

INTRODUCTION

Consolidated Spire Ventures Ltd. (“Spire) is a Canadian-based junior exploration & development company active in gold exploration. The Company's objective is the acquisition and exploration of high quality gold and other precious metal projects.

At present, the Company is focusing on two projects: the 107.9 sq. km 100% owned Prospect Valley Gold Property, located within the Spences Bridge Gold Belt near Merritt, British Columbia, Canada and the Campanario Gold Property in Mexico.

Financings totalling $3.2 million in 2006 provided the Company with the funds to facilitate the summer drill programs on the Prospect Valley Property in B.C. and to further exploration on the Campanario Property in Mexico.

PROJECTS IN HAND

(1) Canada ( 2007 Objective: To develop a large multi-million ounce gold open pit resource )

2007 PLANNED PROGRAMS

- Extensive ground geophysis including sampling and trenching;

- Management and IP surveys;

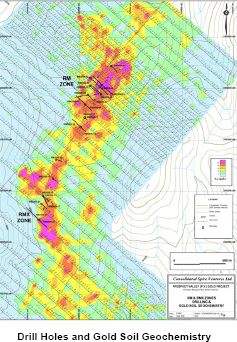

- Extensive deep drilling programs along the 3.5km RM/RMX gold-in-soil anomalies and the new extensions and the new parallel zone from the 2006 magnetometer survey;

- Extend the length and depth of the 2006 1.5km drill proven gold/silver discoveries;

- Technical reviews to pinpoint drilling accuracy toward the expected wider and richer feeder gold/silver zones associated with low-sulphide gold/silver epithermal systems;

- Analytic reviews of drill data towards outlining the beginnings of a mineralized resources.

The Prospect Valley Gold Property is road-accessible from Merritt, BC, which is a regional transportation and supply centre. The property is in close proximity to good infrastructure and is located south of the

large Highland Valley porphyry copper district and immediately west of the Craigmont iron-copper skarn deposit.

HISTORY

A late fall 2006 magnetometer survey discovered two new areas of interest:

The North West Zone (NW Zone) is a 1km-in-diameter magnetic low zone interpreted to be a possible large dome structure. The NW Zone could represent a significant northern extension of the RM Mineral Zone. Further fieldwork, including drilling, is planned to better define the size and character of this structure.

The South East Zone (SE Zone) is a linear magnetic low to the southeast of the RM/RMX Gold Zone and represents a possible significant parallel structure to the Zone. It appears as a large cleaved anomaly running north-south for approximately 0.5km. This zone is open to the north and south for expansion. Further fieldwork is planned to outline the size and gold potential of this zone.

The southern extension of the RM/RMX Gold Zone will be the subject of an upcoming field program. A complete interpretation of all data for the RM/RMX epithermal zone is currently underway in support of the proposed extensive 2007 drill program, which will test deeper and strike-extending mineral target areas.

The Summer 2006 drill program on the Prospect Valley Gold Property completed holes RM2006-1 to RM2006-23, for a total of 3,734m drilled on the RM/RMX Gold Zone. The drill program confirmed an epithermal quartz-vein/alteration system on the RM/RMX Zone, which extends at least 1.5 km, with the mineralization open to extension to the northeast and southwest.

Numerous significant gold and silver drill hole intercepts were obtained throughout the 2006 diamond drill program.

Of particular interest is drill hole RM2006-21, drilled at the southerly known extent of the RM/RMX epithermal mineral system.

In drill hole RM2006-21, the weighted average grade across 45.7m (37.2 - 82.9m) is 1.57 g/t Au. Within this 45.7m interval, higher grade intercepts include:

| 43.1 - 48.8m (5.7m) | 2.51 g/t Au |

| 50.9 - 52.4m (1.5m) | 9.54 g/t Au |

| 54.0 - 57.0m (3.0m) | 1.99 g/t Au |

| 8.85 g/t Ag | |

| 63.5 - 76.8m (13.3m) | 1.75 g/t Au |

| 14.77 g/t Ag |

Drill hole RM2006-21 demonstrates a widening of the gold-silver epithermal system towards the more southerly RMX portion of the continuous RM/RMX gold zone. Drill hole RM2006-21 contained consistent significant gold and silver values across an interval exceeding 50m. An assay value of 9.541 g/t Au was returned from the interval 50.9 - 52.4m (1.5m). The recent drilling work has substantiated the strong potential for a bulk tonnage, near surface mineral resource in this portion of the mineral property.

Drill hole RM2006-21 was drilled 100m southwest of the common drill hole setup for holes RM2006-15 and RM2006-16, which contained the following favourable assay intervals:

| RM2006-15 | |

| 52.1 - 55.0m (2.9m) | 1.85 g/t Au |

| 72.5 - 77.1m (4.6m) | 2.03 g/t Au |

| 80.3 - 81.2m (0.9m) | 3.34 g/t Au |

| 82.0 - 85.6m (3.6m) | 2.41 g/t Au |

| RM2006-16 | |

| 83.1 - 86.6m (3.5m) | 2.10 g/t Au |

Drilling was also carried out 100m southwest of drill hole RM2006-21, with the drilling of the two common-setup drill holes RM2006-22 and RM2006-23. These two drill holes were drilled to test the western edge of the gold-in-soil geochemical anomaly. Anomalous gold values up to 1.2 g/t Au were obtained in RM2006-23.

Recent surface mapping work on the property has located strong concentrations of quartz float approximately 100m east of the collar location of drill holes RM2006-21 and 23, thus suggesting the main epithermal zone was not reached by drill hole RM2006-22, which was drilled south-easterly towards the area of the surface quartz concentrations. This area of the property will receive further drill testing during the planned fall diamond drill program.

Drill hole RM2006-18 and RM2006-19 tested the intervening area between common-setup drill holes RM2006-13 and –14 and common-setup drill holes RM2006-15, -16, and –17. Drill hole RM2006-19 contained consistently anomalous gold values (1.2 – 2.9 g/t Au) from 50.3 to 85.0m (34.7m). Drill hole RM2006-20 was drilled at the northeast known extent of the RM zone and contained sporadic anomalous gold values to 2.15 g/t Au. Most of the holes also encountered lower grades over 10’s of metres of length.

Petrographic and geochemical interpretations by company geologists have led to the conclusion that this new surface and underground gold discovery is high in the system (only top 100 or so metres tested to date). It is anticipated that larger and richer grade feeder systems are yet to be discovered by deeper strike-extending drilling to be carried out during the 2007 diamond drill program.

The Company is highly encouraged with results from this latest drill program on the RM/RMX epithermal gold zone, and looks forward to the expansion of the presently known mineral zone in 2007.

In April 2006, Spire announced that the Induced Polarization (IP) geophysics survey had been completed on the RM/RMX area of the Prospect Valley Property. The program consisted of 27 lines at an average length of 1.66 km per line at 100m spacing totalling 44.95 km IP and 44.50 km Mag. Results of the IP geophysics define a large resistivity anomaly which is believed to reflect a silica-rich, gold-bearing epithermal vein-breccia system. The resistivity anomaly is coincident with the RM/RMX gold-in-soil geochemical anomaly outlined over an area of 3,000m by 400m.

During the 2005 field season, Spire focused solely on the Anomaly Cluster 1 area located in the heart of the 107.9 sq.km property. The Company followed up the previous years’ successes related to the multi-element soil anomalies and the RM and RMX trench showings. The exploration program was carried out in two parts. Both stages included the establishment of an extensive control grid with commensurate prospecting and soil sampling over the RM/RMX zones. The multi-element soil anomaly was greatly expanded to a size of about 3,500m by 400m covering an estimated grid of 8.4 sq.km.

property. The Company followed up the previous years’ successes related to the multi-element soil anomalies and the RM and RMX trench showings. The exploration program was carried out in two parts. Both stages included the establishment of an extensive control grid with commensurate prospecting and soil sampling over the RM/RMX zones. The multi-element soil anomaly was greatly expanded to a size of about 3,500m by 400m covering an estimated grid of 8.4 sq.km.

Much of the gold and related pathfinder element mineralization is typically found in weathered, variably porphyritic, chlorite altered basalts with minor limonitic-quartz veins, stockworks and breccias, all of which are typical characteristics of a low sulphidation epithermal gold exploration target. Trench and soil results to date have demonstrated the large size and bulk tonnage potential of the RM and RMX gold system.

Reconnaissance exploration has identified significant new low-sulphidation epithermal gold-silver mineralization at several locations on the property.

(2) Mexico

The Campanario Gold Property was optioned from Almaden Minerals Ltd. (TSX:AMM) in the fall of 2005 and is located 25 km southwest of Oaxaca City, Mexico. Under the terms of the agreement Spire has the right to acquire a 60% interest in this recently acquired 10,003-hectare property.

MANAGEMENT

Consolidated Spire Ventures possesses strong management, financing capabilities and an experienced technical team. The Company’s focus is on projects that provide investors with an opportunity to participate in a potentially new major gold discovery. These important factors, coupled with a conservative cost conscious approach to developing exploration programs, have the potential to benefit the company and its shareholders into the future. The Company is also currently reviewing other potential acquisitions and interests in North America and Internationally.

Robert Brian Buchanan – President and CEO

George Gorzynski – Director and Professional Engineer

Shiraz (Raz) Hussein – CFO and Secretary

Brian V. Hall – Director and Professional Engineer

NEWS UPDATE

On March 8, 2007, Consolidated Spire Ventures Ltd. announced that it has arranged a non-brokered private placement of two million units at 25 cents per unit, for the gross proceeds of $500,000. The proceeds of this private placement will be used to implement the advanced exploration program at the Yago gold/silver property in Nayarit, Mexico, the Campanario property in Oaxaca, Mexico, the Prospect Valley gold property in British Columbia and for general working capital.

On February 28, 2007 Consolidated Spire Ventures Ltd. has released an update on its recently optioned Yago gold/silver property from Almaden Minerals Ltd. Victor Jaramillo, PGeo, exploration manager, and R. Brian Buchanan, president of consolidated Spire, are currently on the Yago gold/silver property in Mexico. This site visit is expressly for determining and executing an immediate exploration program. Exploration crews are now on site to start the initial phase of exploration work.

On February 23, 2007 Consolidated Spire Ventures Ltd. has granted incentive stock options to directors, officers, employees and consultants to purchase up to a total of 118,000 common shares in the capital stock of the company exercisable for a period of five years at a price of 27 cents per share.

On February 19, 2007 Consolidated Spire Ventures Ltd. has optioned the Yago gold/silver property in Mexico from Almaden Minerals Ltd. Under the term of the agreement, Spire has the right to acquire a 60% interest in the property in consideration for undertaking a work program on the property aggregating $3.5 million (U.S.) and issuing a total of 800,000 shares to Almaden over a five-year period.

On January 30, 2007 Consolidated Spire Ventures Ltd. has appointed Victor Jaramillo, PGeo, as manager of exploration and development to over see Spire's 107.9 square kilometer Prospect Valley gold property located within the Spences Bridge gold belt, 35 km west of Merritt, B.C., and the Campanario gold-silver property, Oaxaca state, Mexico. Mr. Jaramillo's involvement will be to direct day-to-day operations and oversee any new exploration and mining projects that become part of Spire's property portfolio.

On January 18, 2007 Consolidated Spire Ventures Ltd. outlined its plan for 2007 on the 100% owned, 107.9 square kilometre Prospect Valley gold property, located within the Spences Bridge gold belt, 35 kilometres west of Merritt, B.C., Canada.

Planned programs for 2007:

- technical compilation work to complete plans for a intensive 2007 field program;

- airborne geophysics survey (MAG and EM) over entire property;

- continuing sampling and trenching;

- continuing ground magnometer surveys to complement fieldwork programs in preparation for drilling;

- extensive deep drilling program targeting below the wide gold intercepts found in 2006, to test the potential for increasing gold grades at lower levels in the epithermal system; and

- additional drill testing of other recently discovered gold targets.

On January 12, 2007, Consolidated Spire Ventures Ltd. announced that it has granted incentive stock options to certain directors, officers, employees and consultants to purchase up to a total of 300,000 common shares, in the capital stock of the Company exercisable for a period of five years at a price of 25 cents per share.

On November 27, 2006 Consolidated Spire Ventures Ltd. has completed various phases of the 2006 fall exploration program on the 100% owned 107.9 square-kilometre Prospect Valley gold property. The Prospect Valley property is located 30 kilometres west of Merritt, B.C., Canada, in the Spence's Bridge gold belt. During the recent exploration program, several new areas of interest were discovered, expanding beyond previously known mineralized areas.

On October 13, 2006, Consolidated Spire Ventures Ltd. announced property agreement for Prospect Valley gold project located in B.C.

On October 10, 2006, Consolidated Spire Ventures Ltd. announced that it has reached terms of agreement with Almaden Minerals Ltd., subject to formal documentation and

regulatory approval, to acquire the remaining 40% interests in the Prospect Valley gold property located

in B.C.

On September 6, 2006, Consolidated Spire Ventures Ltd. released the final drill results of the summer diamond drill program on the 107 sq.km Prospect Valley gold property located 30 km west of Merritt, B.C. With the completion of drill holes RM2006-18 to RM2006-23, a total of 3,734 metres were drilled in the RM/RMX zone. The drilling project intersects 45.7 m of 1.57 g/t gold.

On August 1, 2006, Consolidated Spire Ventures Ltd. announced that it has recently completed the summer stage diamond drill program on the Prospect Valley gold property located 30 km west of Merritt, B.C. The most recent phase of the 2006 diamond drill program was carried out from July 6 to 20, 2006. A total of 882.4 metres were drilled with the completion of six drill holes. RM2006-06 drill hole returned 9.54 g/t Au over 0.7 m. The Company plans for fall drill program on the Prospect Valley gold project.

On July 19, 2006, Consolidated Spire Ventures Ltd. announced that it has granted incentive stock options to certain directors, officers, employees and consultants, to purchase up to a total of 850,000 common shares, in the capital stock of the Company exercisable for a period of one to five years at a price of 38 cents per share. The closing price of the Company's shares was 33 cents. The granting of the stock options is subject to regulatory approval.

On July 13, 2006, Consolidated Spire Ventures Ltd. released drill core assay results from the continuing 2006 drilling program on the Prospect Valley gold property. RM2006-04 drill hole returned 10.5 m of 2.17 g/t gold. The Company is highly encouraged by results obtained from the early stage drilling program and plans ongoing exploration of the RM/RMX gold zone.

On July 12, 2006, Consolidated Spire Ventures Ltd. has received the drill core assay result from the continuing 2006 drilling program on the 107 square kilometer Prospect Valley gold property located 30 kilometres of Merritt, B.C.. Spire has drill delineated a 1.2 kilometre northeast-trenching mineralized zone contained within a new epithermal gold system with an indicated minimum strike length of 3.5 kilometres previously outlined by surface work. Seventeen holes have been completed along 1.2 kilometres of the strike length of the RM/RMX gold zone, with the majority of drill holes containing significant gold and silver values associated with epithermal-style alteration and quartz veining.

On June 12, 2006, Consolidated Spire Ventures Ltd. has released the drill core assay results from the first six holes of its 2006 drilling program on the 107 square kilometre Prospect Valley gold property near Merritt, B.C. - part of the Spences Bridge gold belt optioned from Almaden Minerals Ltd. Spires confirms the presence of a new epithermal gold system with a minimum strike length of 3.5 kilometres. Highlights:

- 12 holes have been completed along 400 metres of the strike length. Ten of the 12 holes have intersected epithermal stockworks, veining, banding and zones of breccia over an eitht-to 12 metre width

- results indicate drilling has intercepted multiple gold zones within the top of the epithermal gold system

- grade is increasing with depth as indicated in drill hole RM-2006-04 ( minus 60 degrees ), which was drilled below RM-2006-03 ( minus 45 degrees ), which included intervals

of 13.5 metres of 1.88 grams per tonne gold of which includes three metres of 4.20 grams per tonne gold

- partial results from drill hole RM-2006-06 reveal the hole to be strongly anomalous in gold ( 0.3 to 1.0 gram per tonne gold ) with an interval assaying 9.54 grams per tonne gold for 1.0 metre

- the company is continuing to drill the zone along strike ands depth, and

- a second drill has begun testing a separate epithermal quartz vein system on the NIC zone

The 2006 drilling program began on May 10, 2006 and is expected to continue into the fall of 2006.

On June 08, 2006, Consolidated Spire Ventures Ltd. has commenced diamond drilling on the NIC showing ( northeast section ) of the 107 square kilometre Prospect Valley gold property near Merritt, B.C., part of the Spences Bridge gold belt, optioned from Almaden Minerals Ltd.

The NIC drilling program will investigate epithermal quartz zones originally discovered by prospector Ed Balon of Almaden Minerals Ltd. A ground magnetics survey is currently being completed by Rio Minerals Ltd. This work has defined drill target in an area where earlier reconnaissance prospecting identified an areas of epithermal quartz veins and breccias.

On June 07, 2006, Consolidated Spire Ventures Ltd. has granted incentive stock options to certain directors, officers, employees and consultants to purchase up to a total of 850,000 common shares, in the capital stock of the company, exercisable at a price of 75 cents for a period of one to five years, subject to the acceptance of the TSX Venture Exchange.

On May 30, 2006, Consolidated Spire Ventures Ltd. has released an update on the 2006 drilling program on the 107 square kilometre Prospect Valley gold property near Merritt, B.C., part of the Spences Bridge gold belt, optioned from Almaden Minerals Ltd. The 2006 drilling program began n May 10, 2006, and is expected to continue into the fall of 2006. It is anticipated that the drilling will occur in several phases. Spire anticipates the first phase of the RM/RMX zones will consist of 20-plus holes and eight-plus holes on the NIC. The main focus of the drilling is to test the grade potential of the RM/RMX zone at depth and along its strike length.

On February 06, 2006, Consolidated Spire Ventures Ltd. announced both a brokered and a non-brokered private placement financing to raise gross proceeds of up to $3,200,000.

(1) Pacific International Securities Inc. will act as agent in the brokered offering to raise, on a commercially reasonable efforts basis, up to $2,000,000. Consolidated Spire will issue up to 5,000,000 flow-through units at a price of $0.40 per FT unit.

(2) In addition to the brokered offering, Consolidated Spire intends to raise up to $1,200,000 on a non-brokered basis via the issuance of up to 4,000,000 non-flow through units at a price of $0.30 per NFT unit.

On January 25, 2006, Consolidated Spire Ventures Ltd. announced the start of the IP Geophysics Program on the Anomaly Cluster 1 area of the Prospect Valley Gold Property near Merritt, BC. The IP Geophysics Program starting February 12, 2006 will consist of 40 lines at a length of 1.2 km per line at a 100 m spacing. Work is to be completed by Scott Geophysics. The IP Geophysics Program will be followed, in the spring, by drilling to test the grade potential of the RM/RMX Zone at depth.

On December 07, 2005, Consolidated Spire Ventures Ltd. announced the commencement of a field program on the newly acquired 10,003 hectare Campanario Gold Property, located 25 km southwest of Oaxaca City, Mexico. In November 16, 2005, Spire announced the signing of an option agreement with Almaden Minerals Ltd., whereby Spire can earn a 60% interest by expending 3.5 dollars in staged exploration expenditures, and giving Almaden a total of 500,000 shares of Spire over a five year period.

On November 30, 2005, Consolidated Spire Ventures Ltd. provided an exploration update on the 107 sq.km Prospect Valley Gold Property near Merritt, BC. During the fall field crews have concentrated work on the southern extension of the RM Zone in the central part of the Property. An area of approximately 5 km x 2 km has been covered with a detailed soil sample grid. Eventually Spire plans to complete the soil grid and area of trenching to overlap with the PV area located south-southwest of the RM area. Earlier reconnaissance prospecting in the PV area found numerous float cobbles of quartz veins and breccias which returned values ranging up to 43.3 g/t gold and 130.7 g/t silver in grab samples.

On November 14, 2005, Consolidated Spire Ventured Ltd. announced that the Company has given notice to MacMillan Gold Corp. that Spire declines to proceed with its option under the Letter of Intent dated November 10, 2004 with MacMillan Gold Corp. on the Tetasiari property in Mexico.

On November 08, 2005, Consolidated Spire Ventured Ltd. announced that the Company has granted incentive stock options to certain directors, officers, employees and consultants to purchase up to an aggregate of 465,000 common shares, in the capital stock of the Company exercisable for a period of one to five years at a price of $0.18 per share. The closing price of the Company's share was $0.19. The granting of the stock options is subject to regulatory approval.

On October 13, 2005, Consolidated Spire Ventures Ltd. announced the expansion of the eastern boundary of the previous 9,242 hectares of the Prospect Valley Gold Property near Merritt, BC, that is optioned from Almaden Minerals Ltd. The Companies have recently completed the staking of new mineral claims along the eastern boundary of the property. This eastern expansion covers the southern projection of the NIC prospect where earlier sampling returned 9.24 g/t gold across 0.5 m (see Spire news release dated July 12, 2004). Concurrently the Companies have converted all their existing Prospect Valley claims to mineral claims under new mining legislation in British Columbia, which allowed a further modest expansion of the property on all sides. In total the expanded property now encompasses one contiguous block of claims covering 10,796 hectares or 107.9 sq.km (see the corporate website www.spireventures.com for map).

On October 07, 2005, Consolidated Spire Ventures Ltd. announced that the Company has closed a Private Placement financing of

1,900,000 units at $0.175 per unit for the gross proceeds of $332,500. The proceeds of this private placement will be used to continue the exploration program at the Prospect Valley Gold Property in BC, Tetasiari Gold-Silver Project in Mexico, and for general working capital.

On September 29, 2005, Consolidated Spire Ventures Ltd. announced that a field program of additional soil sampling and trenching has begun on the RM Gold Zone of the Prospect Valley Gold Property near Merritt, BC, optioned from Almaden Minerals Ltd. Results to date have demonstrated the large size and open pit mine potential of the RM gold system. This continuing fieldwork is intended to outline the entire extent of the RM gold system in order to prioritize targets for later trenching and drilling.