![]()

![]()

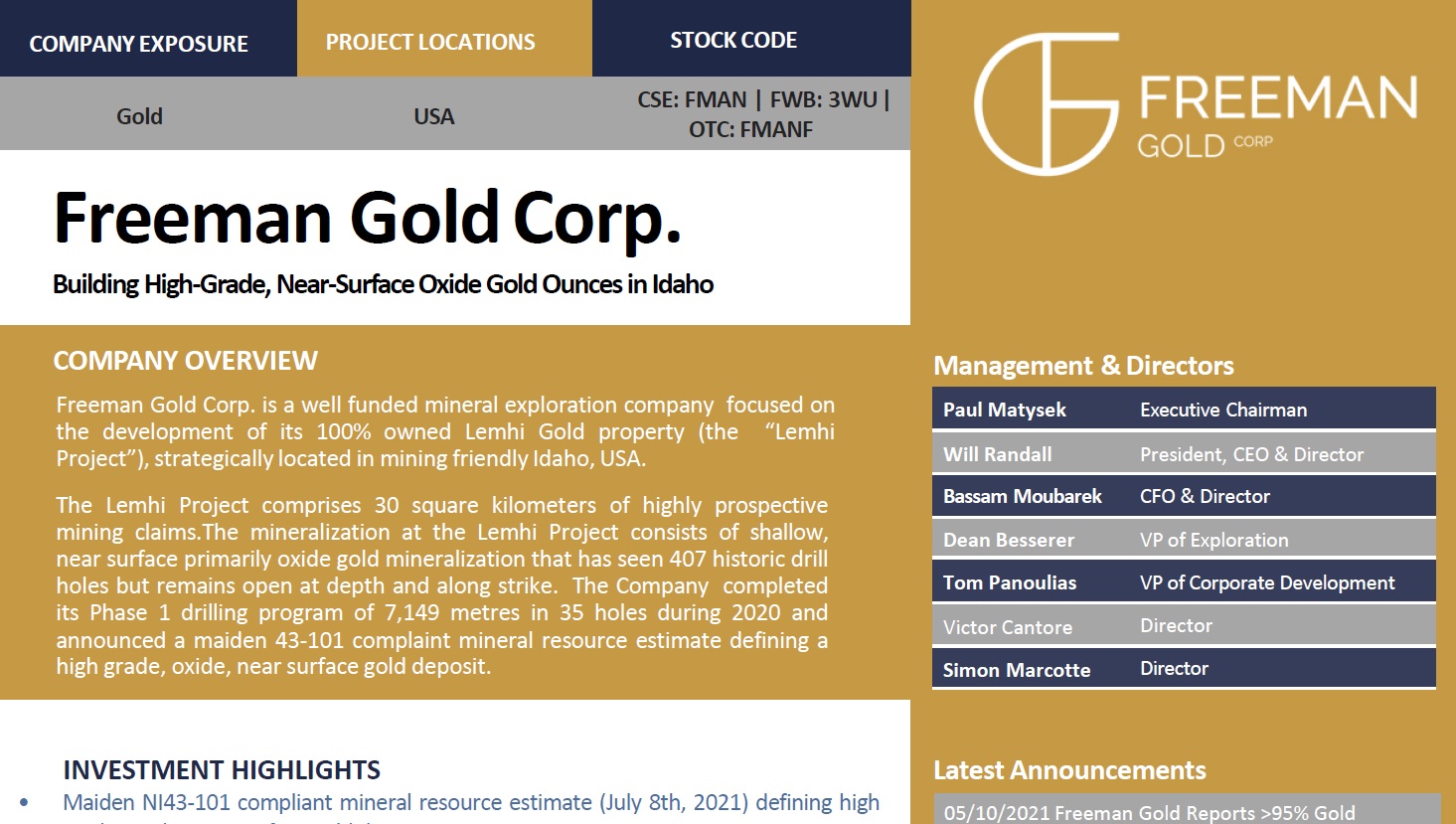

Freeman Gold Corp.

Company Data

| Introduction

| Projects in Hand

| Management

News Update

| Chinese

| Address : |

Suite 1570, 505 Burrard Street Vancouver, BC Canada V7X 1M5 |

| Tel No.: | 416-294-5649 |

| Web Site: | www.freemangoldcorp.com |

| E-mail: | tom@freemangoldcorp.com |

| Contact Person: | Tom Panoulias |

| Position: | VP of Corporate Development |

| Traded Market: | CSE | FWB | OTCQB |

| Traded Symbol: | FMAN | 3WU | FMANF |

| Outstanding Shares: | Approx. 93 million |

| 52 Week High: | $ 0.65 |

| 52 Week Low: | $ 0.275 |

| Present Price: | Click Here |

Freeman Gold Corp. is a well funded mineral exploration company focused on the development of its 100% owned Lemhi Gold property (the “Lemhi Project”), strategically located in mining friendly Idaho, USA. The Lemhi Project comprises 30 square kilometers of highly prospective mining claims. The mineralization at the Lemhi Project consists of shallow, near surface primarily oxide gold mineralization that has seen 407 historic drill holes but remains open at depth and along strike. The Company completed its Phase 1 drilling program of 7,149 metres in 35 holes during 2020 and announced a maiden NI 43-101 compliant mineral resource estimate defining a high grade, oxide, near surface gold deposit.

TARGET: To define a >1.5M oz primarily leachable, open pit deposit in Idaho.

Lemhi Gold Project, Idaho

The Lemhi Gold Project is strategically located in the heart of Lemhi County, Idaho. Idaho is one of the top ranked jurisdictions globally with an extensive and rich mining history. This prolific area is in close proximity to Revival Gold (Beartrack-Arnett Project), Barrick, Agnico Eagle among others.

Phase 1: Resource Diamond Drilling

- 7,149m of drilling completed in 35 drill holes in 2020

- Focusing on historical resource area, primarily on patented claims

- Combination of twin and infill drilling

- Near surface mineralization hosting oxide gold

- Flat lying high-grade mineralization

- Amenable to open pit mining

- Multiple high-grade intervals close to surface

- Mineralization open on strike and at depth

Phase 2: Resource Expansion Drilling

- Deposit open in most directions, including at depth

- Second drill campaign to focus on high priority target areas where previous work has identified gold mineralization open on strike and at depth

- Increased understanding of deposit geology will help with more accurate targeting and modeling

- Ground geophysics and geochemical surveys will aid in targeting strike and depth extensions

Favourable Metallurgy

- Initial metallurgical testing indicates gold recoveries between 95% and 98%

- Conventional tank leach processing favoured

- Recovery of coarse gold with gravity pre-treatment

- Moderate grind size (80% passing 110 microns)

- High recoveries take advantage of high grade in positive gold price environment

- Leach response and recoveries consistent over wide spatial area, depths (tested down to 202 metres below surface) and head grades (0.4 to 2.1 g/t Au)

- Next phase of test-work to confirm recoveries over larger spatial area ahead of economic studies

- Programs designed and supervised by Frank Wright (P.Eng.), executed by SGS Canada Inc. (BC)

Phase 3: Blue Sky Exploration Upside

- Large land package essentially unexplored despite proximity to intrusive

- These deposits are often part of a larger mineralized system, which have been unexplored

- Major Structure at the neighboring Bear Track Deposit has yielded multiple gold discoveries along strike (6.5km)

- 11 high priority target areas have been defined for follow-up exploration at the Lemhi project

- 633 soil samples and 145 rock grab and channel samples analysed; 565 line km of ground magnetics and 1.4 sq. km of 3D IP Data surveyed

- Grab samples discovered 5 targets with a total of 54 samples >1 g/t Au with assay values up to 450 g/t Au

Investment Highlights

- Maiden NI 43-101 compliant mineral resource estimate (July 8th, 2021) defining high grade, oxide, near surface gold deposit:

- 749,800 oz Au at 1.02 g/t in Indicated category

- 250,300 oz Au at 1.01 g/t in Inferred category

- 100% owned advanced project: almost 80,000 metres of drilling including 7,000 metre resource classification drill program completed Q4 2020

- Shallow high-grade oxide gold mineralization intersected: 14 g/t Au over 10 metres, 3.4 g/t Au over 51.6 metres, 2.5 g/t Au over 151 metres, and 1.1 g/t Au over 189.1 metres

- Permitting advantage: open pit, leachable resource primarily on patented claims, where Freeman owns mineral and surface rights

- Initial metallurgical testing indicates excellent gold recoveries between 95% and 98%

- Top tier management team with impressive track record of success in the mining industry

Management and Directors

Paul Matysek, Executive Chairman

Mr. Matysek is a geologist/geochemist by training, a successful alpha entrepreneur and creator of shareholder value with over 40 years of experience in the mining industry. Since 2004 as either CEO or Executive Chairman, Mr. Matysek has sold five publicly listed exploration and development companies, in aggregate worth over $2 billion. Most recently, he was Executive Chairman of Lithium X Energy Corp., which was sold to Nextview New Energy Lion Hong Kong Limited for $265 million in cash.

Will Randall, President, CEO & Director

Mr. Randall is a professional geologist with over 20 years of experience in the mining and mineral exploration industry. One of the early movers in the lithium brine industry, where he acquired, discovered and developed the Sal de los Angeles lithium brine project in Argentina. He has been involved in raising over $200M and the successful development of several mining projects, including joint ventures with majors and national governments.

Bassam Moubarak, Chief Financial Officer and Director

Mr. Moubarak has over 10 years of experience in the mining industry. Most recently, he was Chief Financial Officer of Lithium X Energy Corp.

Dean Besserer, Vice President of Exploration

Mr. Besserer has more than 2 decades of exploration experience working in over 50 countries, including much of North America, often leading projects with annual exploration budgets exceeding $20 million U.S. He was the Vice President and partner at APEX Geoscience Ltd.

Tom Panoulias, Vice President of Corporate Development

Mr. Panoulias is a capital markets professional with over 15 years of experience.

He has previously worked at Echelon Wealth Partners, Fraser Mackenzie, and Dundee Capital Markets, raising over one billion dollars for issuers in the mining sector and advising senior management teams on numerous merger and acquisition transactions. Prior to entering capital markets. Mr. Panoulias held senior roles at Kinross Gold Corporation and TVX Gold Inc. in corporate development.

Victor Cantore, Director

Mr. Cantore is a seasoned capital markets professional specializing in the resource and high-tech sectors. He has over 25 years of advisory and leadership experience.

Simon Marcotte, Director

Mr. Marcotte has over 20 years of capital market experience.

On June 07, 2022, Freeman Gold Corp. announced that it has received approval of a Permit to Appropriate Water ("Water Rights"). The Permit No. 75-15005 was approved May 23, 2022, by the Idaho Department of Water Resources ("IDWR"). Freeman's Water Rights are the only registered groundwater right in the Lemhi Gold Deposit's basin. The application's water usage of 0.54 cubic feet per second was based on typical maximum consumption rates for gold mining operations of up to 100,000 ounces of gold per year. The usage rates are subject to change and Freeman can submit an application to amend (increase) the authorization, if required, as the Lemhi Gold Project advances through engineering and economic studies.

"The approval is another key component of the development of the Lemhi Gold Deposit," stated Will Randall, CEO of Freeman. "These Water Rights concede Freeman the ability to use up to 0.54 cubic feet per second of water for a gold mining operation from aquifers that do not have any other conceded water permits. This is a crucial step in de-risking the project and demonstrates the value of mining-friendly tier-one jurisdictions such as Idaho."

On March 10, 2022, Freeman Gold Corp. has released final results from the comprehensive 2021/2022 metallurgical testing program conducted on the Lemhi gold deposit, located in eastern Idaho, United States.

Expanding from previous work (see October 5, 2021, News Release), the metallurgical test work has now been completed to a level to allow its inclusion into a Preliminary Economic Assessment ("PEA"). Gold cyanidation extractions averaged 95%, based on 38 variability samples, with head grades ranging from 0.2 g/t to 10.9 g/t Au, and averaging 1.02 g/t. Samples were collected over a large spatial area considered representative of the 2020 maiden mineral resource (see July 8, 2021, News Release).

On March 03, 2022, Freeman Gold Corp.'s common shares have qualified to trade on the OTCQX Best Market and will begin trading today under the symbol FMANF. Freeman is upgrading to the OTCQX Best Market from the OTCQB Venture Market. In addition, the common shares of the company will continue to trade on the TSX Venture Exchange under the symbol FMAN.

On February 07, 2022, The TSX Venture Exchange has approved Freeman Gold Corp.'s application to list its common shares on the TSX-V. Effective at market open on Feb. 8, 2022, the shares will commence trading on the TSX-V.

The Company's trading symbol "FMAN" will remain unchanged and shareholders will not be required to take any action in connection with Freeman's listing on the TSX-V. The Shares will also continue to be listed on the OTCQB Marketplace in the United States under the symbol "FMANF" and on the Frankfurt Stock Exchange under the symbol "3WU".

On February 02, 2022, Freeman Gold Corp. has provided an update on its Lemhi gold project in Idaho. Further to the announcement dated Oct. 27, 2021, initial drilling at Lemhi commenced at the newly identified Beauty zone during Q4 2021. Three diamond drill holes (FG21-001 to FG21-003) totalling 328 metres were completed and have now been sent to the laboratory for analysis.

After completing drilling at the Beauty zone, the diamond drill was moved to the Lemhi gold deposit. Thus far, three drill holes totalling 797 metres as part of the designed phase 2 drill program have been completed. All three drill holes were stepouts to the west of the deposit (FG21-004, FG21-005 and FG22-001 -- 85-metre stepout, 93-metre stepout and 17-metre stepout, respectively). Continuation of phase 2 drilling is currently under way.

On November 12, 2021, Freeman Gold Corp. announced that it has commenced phase 2 diamond drilling at the Lemhi gold deposit and the newly discovered Beauty zone. Drilling will be completed utilizing a diamond drill provided by Cabo Drilling (Nevada) Inc.

On November 05, 2021, Freeman Gold Corp. has increased the previously announced non-brokered private placement (Nov. 1, 2021) from $10-million (U.S.) to $13-million (U.S.). The company will issue up to 37,142,857 units at a price of 35 U.S. cents per unit.

Each unit will consist of one common share of the company and one-half of one share purchase warrant, with each warrant entitling the holder thereof to purchase one share for a period of 60 months from closing at a price of 65 U.S. cents per share. The company anticipates closing the offering in late November, 2021.

On October 27, 2021, Freeman Gold Corp. announced that its Phase 2 diamond drill program at the Lemhi Gold Deposit ("Lemhi") and the new Beauty Zone ("Beauty Zone"). The proposed >4,000 m drill program focuses on adding near surface, oxide ounces to the recently reported maiden Mineral Resource Estimate on July 8, 2021. Drilling will also test the recently delineated Beauty Zone which lies approximately 600 metres west of Lemhi and host to a number of high-grade gold rock samples and coincident gold soil geochemistry.

On October 25, 2021, Freeman Gold Corp. has released geochemical results from the newly discovered Beauty zone. This zone lies approximately 600 metres west of the Lemhi Gold Deposit where Freeman recently reported a maiden Mineral Resource Estimate on July 8, 2021 .

In total, 105 rock grab and 347 soil samples have been collected in and around the Beauty Zone. A total of 52 rock samples returned values greater than 1 gram per tonne ("g/t") gold ("Au"), 39 with values greater than 5 g/t Au and 28 samples with greater than 10 g/t Au (up to 450 g/t Au). Rock samples are heavily oxidized and silicified at surface.

On October 5, 2021, Freeman Gold Corp. reports >95% gold recoveries in initial metallurgical testing for the Lemhi Gold Project.